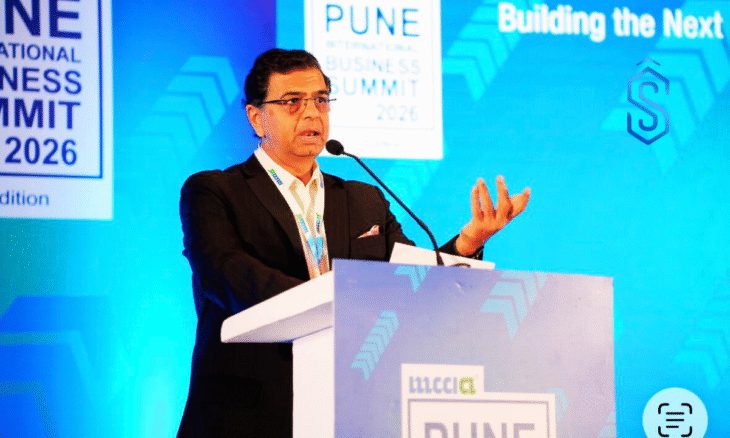

Pune: At the Pune International Business Summit 2026, Sanjeev Krishan, Chairman of PwC India, outlined India’s economic resilience and long-term growth roadmap, describing the country’s journey in a volatile, uncertain, complex and ambiguous (VUCA) global environment.

According to Sanjeev Krishan, India has demonstrated remarkable stability and strength over recent years and is well-positioned to navigate emerging global challenges.

“We are living in a VUCA world – volatile, uncertain, complex and ambiguous. At the same time, it must be said that India has been remarkably resilient. If you look not just at FY25 but also the previous years, India has navigated this difficult global environment very well,” he said.

India is projected to grow at 7.4% in FY26, with expectations for FY27 between 6.8% and 7.2%. Growth is driven by private final consumption at approximately 61.5–62% of GDP and sustained gross capital formation at nearly 30% of GDP over several years. Over the last four years, close to 30% of GDP has been directed toward capital expenditure, marking a structural shift in budgetary allocation.

India’s fiscal position remains stronger than most geographies. Inflation has also been cooling – CPI stood at 6% in FY25 and around 4.6%, declining further in FY26. “All of this means India has the right ingredients to deal with whatever challenges may emerge in the coming years,” he noted.

Sanjeev Krishan on Key Enablers of India’s Growth

Digital Public Infrastructure & Entrepreneurship

India’s growth has become increasingly broad-based, supported by strong digital public infrastructure. For startups and young enterprises, customer acquisition costs have reduced significantly.

India today is home to:

- 76 million MSMEs

- Nearly 250,000 startups

Many of these enterprises are emerging from Tier 2 and Tier 3 cities, reflecting a thriving MSME and startup ecosystem.

“For years, India seemed overly focused on remaining small. But when competing globally, scale matters. It is encouraging that we now recognize the importance of scale — supporting innovation initially, but ultimately encouraging businesses to grow larger and compete globally,” he observed.

Sanjeev Krishan on The Importance of Partnership

Sanjeev Krishan emphasized that partnership will be critical in the coming decade.

Whether in sustainability or technology transformation, collaboration across value chains – OEMs, vendors, and customers – will be essential. MSMEs and startups will play a vital role in enabling these partnerships.

Examples include:

- Agri-tech startups offering personalized crop advisory services

- Platforms enabling digital empowerment for small businesses

- Deep-tech and space-tech startups building on-demand launch vehicles

- Frugal innovation across sectors

“There is tremendous innovation happening in India. The next step is creating a movement — a community of scalable Indian startups,” he said.

Sanjeev Krishan on Role of the Private Sector

Beyond headline investments in semiconductors and chips, the private sector has contributed significantly through asset consolidation and revival.

Through the Insolvency and Bankruptcy Code, stressed assets were consolidated and revived, with recoveries between 34–44%. More importantly, these assets are now productive, strengthening bank balance sheets and releasing locked capital.

“When we say private capex has not risen significantly, we must recognize that private companies have consolidated and revitalized assets through acquisitions under insolvency proceedings,” he explained.

Sanjeev Krishan on Free Trade Agreements (FTAs)

India has signed several Free Trade Agreements and may sign more. However, adoption remains between 25–30%, compared to the global average of 75–80%.

This indicates that partner countries are leveraging FTAs more effectively.

MSMEs and mid-corporates must play a larger role in monetizing FTAs. This requires:

- Financing support

- Process simplification

- Industry body enablement

Recent Budgets have included provisions to support such efforts.

Strategic Initiatives Driving Growth

Key national initiatives include:

- India Semiconductor Mission 2.0

- Electronic Components Scheme

- Rare Earth Corridors

- Urban development corridors

These initiatives create significant opportunities for mid-corporates to scale further.

Also Read: Volar Alta, Periwinkle Technologies Lead AI by HER Finalists at India AI Impact Summit 2026

Sanjeev Krishan on India’s Growth Script: S.C.R.I.P.T.

Sanjeev Krishan described India’s growth framework as “SCRIPT.”

- S – Sustainability

India has made substantial progress in sustainable investments:

- Installed renewable capacity: 253 GW

- Pipeline capacity: 200+ GW

- Target: 500+ GW by 2030

The India Green Hydrogen Mission aims to position India as a low-cost producer of green hydrogen, critical for powering AI-driven data centers sustainably.

Additional measures include:

- Budgetary support for green initiatives

- Relaxations to leverage nuclear energy

- Strong decarbonization efforts

India is increasingly viewed as a global example in sustainable energy adoption.

- C – Consumption

India remains a consumption-led economy and is the third-largest in purchasing power terms.

Consumption drivers include:

- Strong rural demand

- Robust urban consumption driven by IT, professional services, and GCCs

- A significant demographic dividend

India’s large consumer base is also a key reason global companies seek tariff reductions under FTAs.

- R – Research & Innovation

India’s R&D investment landscape is evolving:

- Pharma companies are increasing R&D spending

- Nearly 30% of global chip design work occurs in India-based GCCs

- Stronger IP awareness and protection

- Innovation spans pharmaceuticals, semiconductors, and electronics manufacturing.

- I – Infrastructure

Physical Infrastructure

Significant investments have been made in:

- Roads

- Ports

- Dedicated freight corridors

- Logistics (cost reduced from ~14% to ~8%)

Digital Infrastructure

Digital public infrastructure has been transformative.

Social Infrastructure

Greater investment is needed in social infrastructure. AI-driven transformation demands reskilling and modernization of education curricula to ensure India’s demographic dividend remains relevant.

- P – Policy

Major reforms include:

- GST implementation and rationalization

- Insolvency and Bankruptcy Code

- Production Linked Incentive (PLI) schemes

- Viability Gap Funding

- Competitive federalism

States are increasingly competing to attract investments, with improvements in land, labor, and environmental approvals.

The development of GIFT City as an international financial center stands out as a significant reform.

- T – Talent

India’s talent ecosystem includes:

- 56,000+ higher education institutions

- 44,000 colleges

- 1,100+ universities

India produces a large number of STEM graduates and hosts 1,700–1,900 Global Capability Centres (GCCs), driving chip design, high-value services, and employment.

Cities such as Bhubaneswar and Coimbatore are emerging as GCC hubs.

Additionally, tourism, medical tourism, and heritage-led employment present significant non-STEM job creation opportunities.

- Global Perception of India

In PwC’s Global CEO Survey of 4,700 CEOs, India ranked as the second most desirable investment destination despite global disruption.

This reflects:

- Economic resilience

- Strong public investment

- Value chain integration

- Sustainability leadership

- Policy reform momentum

With continued focus on social infrastructure reform — particularly education — India can emerge as the most desirable investment destination globally.

The Role of MSMEs in the Next Decade

MSMEs remain critical for:

- Exports

- GDP contribution

- Employment generation

Two factors will determine their future trajectory:

- Scale Through Capital

MSMEs must:

- Embrace capital

- Take calibrated risks

- Consider equity dilution where necessary

- Leverage domestic private capital

“Risk-taking and scale will determine whether businesses remain good — or become great.”

- Technology Adoption

AI-driven disruption is inevitable.

“The question is not whether technology will disrupt — it will. The question is: how quickly can we learn and adopt it?”

MSMEs may not need to be first movers, but they must be fast adopters once business models are proven.

Conclusion

India possesses the right growth ingredients:

- Sustainability

- Consumption strength

- Research & innovation

- Infrastructure

- Policy reforms

- Talent

Combined with greater risk-taking, capital access, technology adoption, and education reform, India has the potential to move from being the second most desirable investment destination to the first.