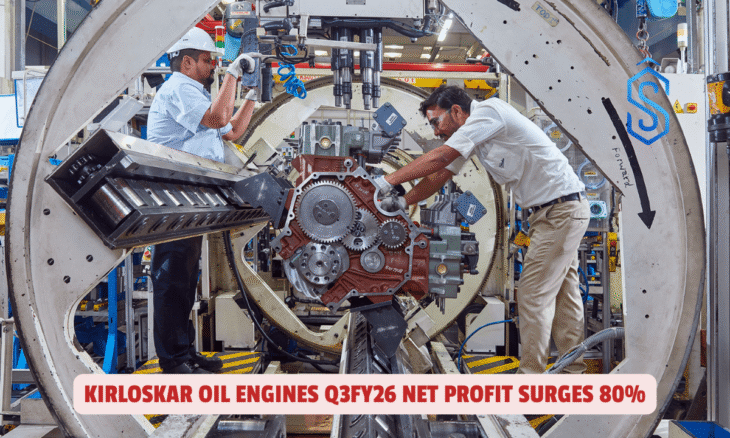

Pune: Kirloskar Oil Engines Limited (KOEL) announced strong financial performance for the third quarter of FY26 (Kirloskar Oil Engines Q3FY26), with standalone net sales reaching ₹1,371 crore, reflecting a 35% year-on-year growth, while standalone net profit rose 80% year-on-year to ₹102 crore.

The company, listed on BSE (533293) and NSE (KIRLOSENG), shared its unaudited financial results for the third quarter and nine months ending March 31, 2026, highlighting broad-based growth across segments.

Kirloskar Oil Engines Q3FY26: Financial Performance Highlights

Commenting on the Q3FY26 results, Gauri Kirloskar, Managing Director, Kirloskar Oil Engines, said: “KOEL has delivered its highest-ever third-quarter sales, driving record year-to-date performance.

Growth was broad-based across segments, with 35% year-on-year growth for the quarter and 25% growth year-to-date, reflecting strong momentum across all businesses.

Also Read: Kirloskar Pneumatic Q3 FY26: PBT Rises to ₹79 Crore; Order Book at ₹1,939 Crore

During the Kirloskar Oil Engines Q3FY26 quarter, we completed the standalone B2C integration. The integration of the Fluid Dynamics business is a strategic milestone that enables sharper segment focus while unlocking synergies across operations.

At Arka, we are progressing well against our stated strategy of building a strong Retail Portfolio with a focus on Used Wheels and Small Ticket LAP to complement the existing SME and Wholesale book.

In the past 9 months, we have opened 85 new branches and disbursed ₹328 Cr in Secured Retail lending division – testament of strong execution on the ground.

With sustained strength in B2B and positive momentum in the Industrial segment, we are well positioned for the remainder of FY26.

Backed by a strong product pipeline and steady progress on our expansion plans, we remain confident in our long-term growth strategy and commitment to sustainable value creation.”

Kirloskar Oil Engines Q3FY26: Standalone Financial Performance

- Net sales: ₹1,371 crore vs ₹1,015 crore (Q3 FY25) – up 35% YoY

- EBITDA: ₹169 crore vs ₹106 crore – up 59% YoY

- EBITDA margin: 12.2% vs 10.3%

- Net profit: ₹102 crore vs ₹57 crore – up 80% YoY

- Cash and cash equivalents: ₹348 crore

Kirloskar Oil Engines Q3FY26: Consolidated Financial Performance

- Revenue from operations: ₹1,873 crore vs ₹1,449 crore – up 29% YoY

- Net profit: ₹126 crore vs ₹67 crore – up 90% YoY

Also Read: PLI Scheme for White Goods: Kirloskar Pneumatic Among Five Companies Selected in 4th Round

YTD FY26 Standalone Performance

- Net sales: ₹4,082 crore vs ₹3,256 crore – up 25% YoY

- EBITDA: ₹544 crore vs ₹401 crore – up 36% YoY

- EBITDA margin: 13.2% vs 12.2%

- Net profit: ₹345 crore vs ₹251 crore – up 37% YoY

YTD FY26 Consolidated Performance

- Revenue from operations: ₹5,585 crore vs ₹4,580 crore – up 22% YoY

- Net profit: ₹420 crore vs ₹305 crore – up 38% YoY

The Board of Directors declared an interim dividend of 125% (₹2.50 per equity share) for FY26.

KOEL noted that the standalone B2C business has been transferred to a wholly owned subsidiary and classified as discontinued operations in standalone results, with no impact on consolidated financial performance.