Pune: Kirloskar Oil Engines Limited (KOEL) (BSE: 533293; NSE: KIRLOSENG), one of India’s most trusted manufacturers of internal combustion engines, generator sets, and agricultural equipment, has announced its highest-ever standalone revenue of ₹1,434 crore in Q1 FY26, marking an 8% year-on-year growth and a robust start to the new financial year (Kirloskar Oil Engines Q1 FY26).

The company also delivered a strong EBITDA of ₹190 crore, with a margin of 13.2%, and a net profit of ₹123 crore, up by 5% compared to Q1 FY25.

Also Read: Kirloskar Ferrous Industries Q1 FY26: PAT Up 27 Per Cent, INR 1698 Cr Consolidated Revenue

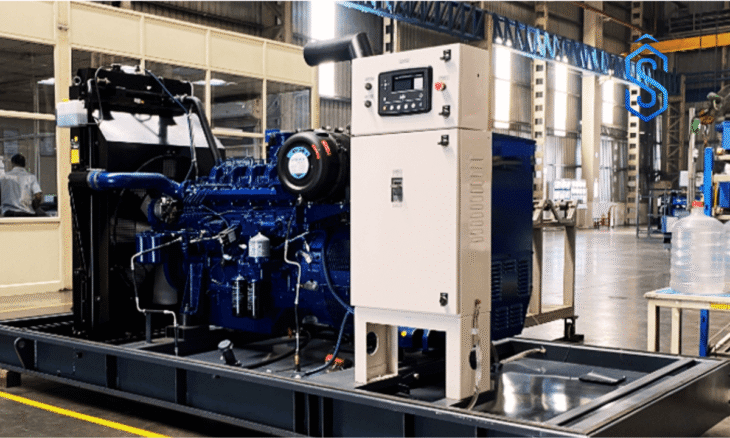

Strong Operational Performance Driven by New Product Acceptance

Speaking on the results, Gauri Kirloskar, Managing Director, Kirloskar Oil Engines, said: “Kirloskar Oil Engines Q1 FY26 results marks a significant milestone for us with our highest-ever standalone net sales. Our new product launches, including the Sentinel and Optiprime series, are gaining strong market traction.

We’re deepening our relationships with key industrial clients and expanding our field infrastructure under the Arka initiative. We remain optimistic about sustained demand as the domestic economy shows continued resilience.”

Also Read: Kirloskar Pneumatic Q1 FY26 Revenue at INR 272 Crore

Kirloskar Oil Engines Q1 FY26 (Standalone): Financial Highlights

- Net Sales: ₹1,434 crore vs ₹1,334 crore in Q1 FY25 (↑ 8% YoY)

- EBITDA: ₹190 crore vs ₹175 crore in Q1 FY25 (↑ 9% YoY)

- EBITDA Margin: 13.2% vs 13.0% in Q1 FY25

- Net Profit: ₹123 crore vs ₹117 crore in Q1 FY25 (↑ 5% YoY)

- Cash & Cash Equivalents: ₹639 crore (net of debt, including treasury investments and excluding unclaimed dividends)

Kirloskar Oil Engines Q1 FY26 (Consolidated): Financial Highlights

- Revenue from Operations: ₹1,764 crore vs ₹1,632 crore in Q1 FY25 (↑ 8% YoY)

- Net Profit: ₹134 crore vs ₹133 crore in Q1 FY25 (↑ 1% YoY)

Also Read: George Verghese Appointed Managing Director of Kirloskar Industries Limited

Focus on Long-Term Growth and Strategic Execution

Kirloskar Oil Engines continues to execute its “2B2B” strategy – a long-term business transformation roadmap focused on building business-to-business solutions across industrial, agricultural, and energy sectors.

With continued investments in R&D and product innovation, the company remains focused on driving efficiency, customer satisfaction, and market expansion – both in India and international geographies.

With a strong order book, sustained cash flows, and a solid product pipeline, Kirloskar Oil Engines Q1 FY26 results reinforce the company’s growth momentum and position it well for the remainder of the financial year.